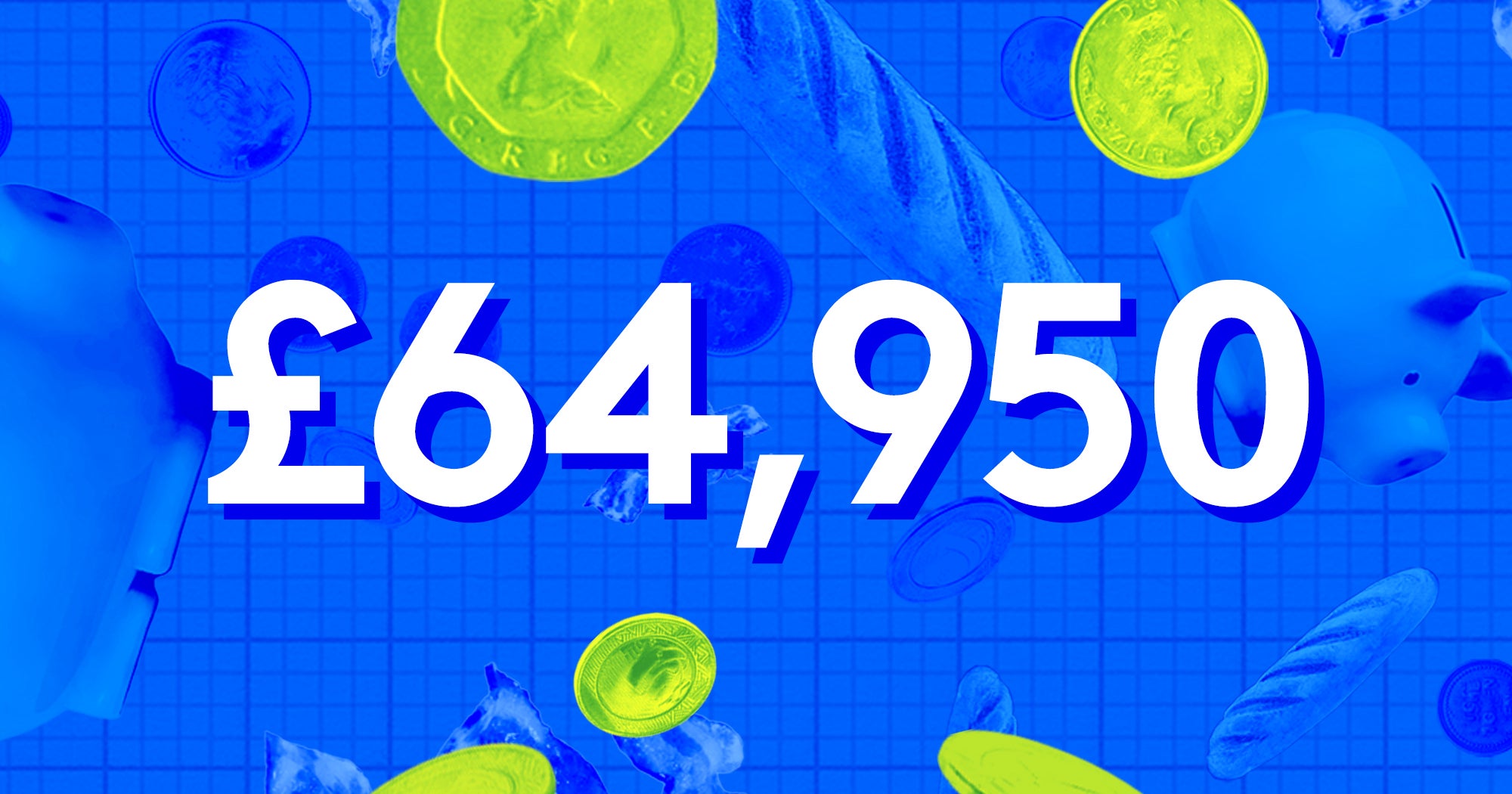

Money Diary: An Assistant Health & Safety Manager On £35,000

Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last penny.This week: “I’m a 27-year-old living in Bristol. I moved here six months ago after taking a year out to go travelling with my boyfriend, B. This is something I had wanted to do since I was 18 but never managed to save for until lockdown. Since getting home I have been working hard to get myself back into a good financial position, while starting from square one and navigating a move to a new place! I worked in health and safety for years before my travels after falling into it randomly. I honestly didn’t think I would end up back here, but the money is good, and it meant we could move to a city. Overall, I do enjoy my job, but in the future I’d love to work for myself. B is way more frugal than me, and has a safety net through inheritance he received — although as a freelance creative he’s always had to be more money conscious. He’s begun a new venture since we moved here, and his income is slowly becoming more consistent. We split most things 50/50 but will also treat each other depending on who has more disposable income that month. He helped me out massively while we were in Australia, funding the last few months for us both as I had eaten through my savings, which I’m paying him back for monthly. I also have a little debt split over my overdraft and credit card that I’m trying to get rid of as soon as possible! I’m naturally a spender, and used to be terrible with money, despite nearly always having two jobs. Nowadays, I’m a lot more considered with my spending; my short-term goal is to save an emergency fund. I would love to be in a position where we can buy a house in the future.”Occupation: Assistant health and safety managerIndustry: Events Age: 27Location: BristolSalary: £35,000Paycheque Amount: £2,260Number of housemates: Three — my boyfriend B, housemate J, and our cat, M.Pronouns: She/herMonthly ExpensesHousing costs: £480 rent (me and B pay 30% each, our housemate pays 40%)Loan payments: £250 to B monthly; £23 monthly on a coffee machine (0% over 12 months).Pension? I pay 5% (around £95 pcm) and my employer pays 3%.Savings?: £100 in a holiday savings account.Utilities: My third comes to £77 council tax; £52 energy/gas; £10.83 internet; £16.67 water.All other monthly payments: £12 flea, tick and wormer subscription; £6.54 pet insurance; £21 car tax, split with B. Subscriptions: £14.99 Spotify, split with B. £10 rolling phone contract; £34 car insurance; £2.99 Apple storage.Did you participate in any form of higher education? If yes, how did you pay for it?No, I remember thinking I couldn’t go to uni because it cost too much money. Looking back, I wish I had understood my options more clearly as maybe I would have gone. Growing up, what kind of conversations did you have about money? I remember it being a point of contention, especially between my parents who weren’t together, and didn’t speak. My dad lived very hand-to-mouth, and my mum used to buy a lot through catalogues and got herself into some bad debt. My mum had us young and took on all of the childcare costs (apart from when we stayed with Dad every other weekend). We never went without food and clothing, however I didn’t really go on family holidays and I never received pocket money. I wouldn’t say either of them ever advised me on money. I just knew it was important to earn it as soon as I could.If you have, when did you move out of your parents’/guardians’ house?I moved out of my mum’s when I was 16 and lived with various family members over the next few years.At what age did you become financially responsible for yourself? Does anyone else cover any aspects of your financial life?I was in full-time work at 17. I still lived with extended family, but I contributed towards rent and food, and paid for everything else on my own (phone, clothing, car and driving lessons, et cetera). However, I understand I paid a lot less than I would have done renting privately. Now I split rent and most living costs with B. I suppose I’m not 100% independent, but I know that if anything ever happened, I would be able to survive on just my wage.What was your first job and why did you get it?I worked at a soft play centre aged 14, hosting children’s birthday parties (ironic as I was still a child myself). I loved this job — I worked with all my friends, and got paid £4.20 per hour which funded weekend cinema or Topshop trips.Do you worry about money now?Yes, especially at the moment. I got myself into around £6,000 worth of debt at aged 18, which I ignored for years until eventually paying it off during lockdown, before I went travelling. Nowadays, I’m facing my debt a lot more head on because I never want to find myself in that position again. Do you or have you ever received passive or inherited income? No, I haven’t.Day One6:30 a.m. — Wake up

This week: “I’m a 27-year-old living in Bristol. I moved here six months ago after taking a year out to go travelling with my boyfriend, B. This is something I had wanted to do since I was 18 but never managed to save for until lockdown. Since getting home I have been working hard to get myself back into a good financial position, while starting from square one and navigating a move to a new place! I worked in health and safety for years before my travels after falling into it randomly. I honestly didn’t think I would end up back here, but the money is good, and it meant we could move to a city. Overall, I do enjoy my job, but in the future I’d love to work for myself. B is way more frugal than me, and has a safety net through inheritance he received — although as a freelance creative he’s always had to be more money conscious. He’s begun a new venture since we moved here, and his income is slowly becoming more consistent. We split most things 50/50 but will also treat each other depending on who has more disposable income that month. He helped me out massively while we were in Australia, funding the last few months for us both as I had eaten through my savings, which I’m paying him back for monthly. I also have a little debt split over my overdraft and credit card that I’m trying to get rid of as soon as possible! I’m naturally a spender, and used to be terrible with money, despite nearly always having two jobs. Nowadays, I’m a lot more considered with my spending; my short-term goal is to save an emergency fund. I would love to be in a position where we can buy a house in the future.”

Occupation: Assistant health and safety manager

Industry: Events

Age: 27

Location: Bristol

Salary: £35,000

Paycheque Amount: £2,260

Number of housemates: Three — my boyfriend B, housemate J, and our cat, M.

Pronouns: She/her

Monthly Expenses

Housing costs: £480 rent (me and B pay 30% each, our housemate pays 40%)

Loan payments: £250 to B monthly; £23 monthly on a coffee machine (0% over 12 months).

Pension? I pay 5% (around £95 pcm) and my employer pays 3%.

Savings?: £100 in a holiday savings account.

Utilities: My third comes to £77 council tax; £52 energy/gas; £10.83 internet; £16.67 water.

All other monthly payments: £12 flea, tick and wormer subscription; £6.54 pet insurance; £21 car tax, split with B. Subscriptions: £14.99 Spotify, split with B.

£10 rolling phone contract; £34 car insurance; £2.99 Apple storage.

Did you participate in any form of higher education? If yes, how did you pay for it?

No, I remember thinking I couldn’t go to uni because it cost too much money. Looking back, I wish I had understood my options more clearly as maybe I would have gone.

Growing up, what kind of conversations did you have about money?

I remember it being a point of contention, especially between my parents who weren’t together, and didn’t speak. My dad lived very hand-to-mouth, and my mum used to buy a lot through catalogues and got herself into some bad debt. My mum had us young and took on all of the childcare costs (apart from when we stayed with Dad every other weekend). We never went without food and clothing, however I didn’t really go on family holidays and I never received pocket money. I wouldn’t say either of them ever advised me on money. I just knew it was important to earn it as soon as I could.

If you have, when did you move out of your parents’/guardians’ house?

I moved out of my mum’s when I was 16 and lived with various family members over the next few years.

At what age did you become financially responsible for yourself? Does anyone else cover any aspects of your financial life?

I was in full-time work at 17. I still lived with extended family, but I contributed towards rent and food, and paid for everything else on my own (phone, clothing, car and driving lessons, et cetera). However, I understand I paid a lot less than I would have done renting privately. Now I split rent and most living costs with B. I suppose I’m not 100% independent, but I know that if anything ever happened, I would be able to survive on just my wage.

What was your first job and why did you get it?

I worked at a soft play centre aged 14, hosting children’s birthday parties (ironic as I was still a child myself). I loved this job — I worked with all my friends, and got paid £4.20 per hour which funded weekend cinema or Topshop trips.

Do you worry about money now?

Yes, especially at the moment. I got myself into around £6,000 worth of debt at aged 18, which I ignored for years until eventually paying it off during lockdown, before I went travelling. Nowadays, I’m facing my debt a lot more head on because I never want to find myself in that position again.

Do you or have you ever received passive or inherited income?

No, I haven’t.

6:30 a.m. — Wake up to my alarm just as B gets back into bed (he’s an early riser and usually spends an hour or so downstairs in the morning working before I get up). One quick cuddle later and I’m nodding back off.

7:10 a.m. — Wake up to another alarm and jump out of bed to rush and get ready as I’m now late — basic skincare it is.

7:40 a.m. — My morning is not off to a great start. When I go to pour my smoothie into my flask the bottom part of the blender comes off and the smoothie goes EVERYWHERE so now I am running extra late and I’m smoothie-less. At least I have my oat latte made by B to take in with me.

8:15 a.m. — Arrive to work and crack on with my to-do list. Firstly, I have a couple of incidents that need investigating, so I’m gathering pictures and statements before compiling them into a report and sending out a safety notification to all staff.

9:15 a.m. — My colleague makes me a spearmint tea, I have this alongside a strawberry yoghurt, which I bought in with me.

12:15 p.m. — For lunch I bought in a homemade wrap of jalapeño hummus, cheese, grated carrot, lettuce and tomatoes. I’ve been trying to bring lunch in everyday to avoid spending and wraps are my current fixation! Eat this at my desk as I’m taking my proper break this afternoon to go for a run.

12:50 p.m. — Order myself a lash lift/brow lamination kit as I’ve got a few social things coming up and I have run out of supplies; it’s on offer for £18.69. I started doing this myself during lockdown as well as my own gel nails, which saves me a fortune. I’ve paid £50 for a brow lamination previously and with this kit can do both my lashes and brows five times, which should last me the rest of the year.

1:30 p.m. — Part of my role is bridging the gap between us and the company we were bought out by last year, so I spend most of my afternoon converting documents from their branding to ours. I don’t mind this kind of task, it’s a bit repetitive but means I can plug away while listening to my podcast — today is Growing Up with Keelin Moncrieff.

3:30 p.m. — Drive down to the river near my office for a 3km run. I’m trying to get back into running after a long hiatus, luckily our director is very flexible and encourages us all to take longer breaks if it’s for something active.

5 p.m. — Finished for the day and drive straight to the food shop. First, I pop into a health food shop to get some vegan bits for my mum. I settle on two blocks of flavoured tofu I know she likes to add to the sweet bits I have already bought, £9.88.

5:15 p.m. — I then head to Aldi where we tend to get most bits. I get chicken, fish, chicken burgers, wraps, cornflakes, milk, almond milk, blueberries, salad leaves, carrot, potatoes, sweet potatoes, onion, basil, chickpeas and yoghurt, and pay on our joint card (£22.35 for my half). Then I go to Asda for some bagel thins, light soy sauce, lemon and lime juice, a packet of crisps to eat on the way home and a small petrol top-up, £8.40 for my half.

6:50 p.m. — Back home and enjoy a long bath, finish my book Boys Don’t Cry which was good but very sad. My cat M sits on the bathmat and patiently waits for me which is quite cute.

9 p.m. — B is back after a long day, so we make a quick dinner of udon noodles with veg and chicken gyoza.

10:30 p.m. — Start a new book, Hamnet, but quickly drift off after only a couple pages.

Total: £59.32

6:30 a.m. — Up and out of bed, I’m determined that today will be a much smoother morning than yesterday. My current skincare is Boots eye cream, La Roche Posay Effaclar Duo cream, Thank You Farmer suncream, and Erborian anti-redness CC cream (my absolute holy grail!).

7:30 a.m. — Divide and conquer with B in the kitchen; I make us both wraps to take into work and finish off some washing up. He makes my smoothie, with no blender mishaps this morning thankfully, and us both an oat latte. We invested in the Sage Barista after Christmas and it’s one of my favourite purchases ever.

8 a.m. — Arrive to work and spend my morning transferring our company’s training matrix onto the new format, and chasing up outstanding training, while sipping my trio of drinks.

12.20 p.m. — Eat my wrap at my desk and buy a jacket on Vinted for £5. I use my Vinted balance to pay most of this so only have £0.53 to pay. Back to the spreadsheets!

1.30 p.m. — Use my break for a short walk — my office is in the middle of an industrial estate, so it isn’t the most visually pleasing place to walk around but it’s still need to get some fresh air and stretch the legs.

5 p.m. — Finished for the day after an uneventful afternoon.

5:20 p.m. — Drive home and I waste no time, putting my pyjamas straight on. Make a start on leek and potato soup for dinner. This is the first time I’ve made it and I think maybe I used the wrong potatoes because it’s turned out quite starchy.

6:15 p.m. — B is home from work, we have our soup with some toasted bagels and talk about our day.

7 p.m. — I have a quick wash, dermaplain my face and put on a sheet mask for some doomscrolling.

8 p.m. — After some tidying up, we settle in to watch some TV and rot for the evening.

9:20 p.m. — B is already fast asleep, and I follow soon after.

Total: £0.53

5:45 a.m. — Wake up to our cat M, purring very loudly and patting B on the face, which means he wants his breakfast. B gets up to go and feed him.

6:20 a.m. — Get up and get myself ready, while chatting to B about how I’m feeling anxious about money. I have a trial shift next week for a local bar and need to ask my current employers for written approval before I can commit to other work (as per my contract). I’ve worked two jobs most of my working life and really don’t want to give up my weekends again, but I’m hoping it can just be for a few months until I feel more on top of things. I know I’m earning a reasonable amount, and my outgoings aren’t too bad, but I’m desperate to pay off my debt as soon as possible and start saving up an emergency fund for a bit of security.

7:20 a.m. — Make myself a tuna bagel to take into work. B makes me my oat latte (he knows acts of service are my love language) and I make my usual smoothie which consists of frozen bananas, cashews, peanut butter, dates and almond milk. I plan on buying some protein powder after my next pay to bulk it up a bit and get some more protein into my day!

8:10 a.m. — Get into work slightly late due to traffic. Respond to some emails and plan out my to-do list for the day. We are going on a big group holiday this summer to Thailand and trying to arrange accommodation between 14 people is a little hectic. I throw out some dates in our group chat to set up a Teams call with everyone and hopefully get some things booked.

10 a.m. — Have our monthly depot meeting, with a few actions for me to take away. Then I assist my colleague with some RAMs they need for an upcoming job. I have a three-mint tea and some Jammy Dodgers.

12:20 p.m. — Eat my bagel at my desk because I’ll be taking a later break again today for a run.

1.30 p.m. — Feeling a bit restless so head out on my run earlier than I originally planned as the weather is gorgeous again today. Drive five minutes down to the river. It’s limited in Bristol for flat areas to run around so this route was a welcome recommendation by my colleague.

4 p.m. — Flagging this arvo and craving some chocolate so my colleague gives me a Cadbury’s Brunch bar for a little pick-me-up. This fuels me for another hour of spreadsheeting.

5 p.m. — Drive straight home, and chat with B and my housemate J for a bit before we start prepping dinner: sweet potatoes, broccoli, and salt and pepper basa which can all go in the oven in a little while, easy!

9:30 p.m. — M makes it known that he would like to go to bed now. He curls up at the end of the bed and I start watching Devil in Ohio enjoying the space while B is downstairs, chilling with J.

10:30 p.m. — Drift off after an episode or so.

Total: £0

6:50 a.m. — A small lie in this morning after snoozing all my alarms. Quickly get ready today, chucking on some yoga flares and a fleece. Today is a comfy day and I’m grateful my office is laidback with what we wear.

7:15 a.m. — The brows are looking big and a bit stiff from some residual glue, but we’ll just ignore that until I can wash them properly after 24 hours.

8 a.m. — Arrive to work in a great mood after a singalong in the car (it’s also Friday, and it’s sunny). Get on with some emails and send out some H&S updates.

10 a.m. — Have a meeting with my manager and director to talk through our objectives for the rest of the year. Come away with some more tasks and crack on with them straight away.

11:30 a.m. — Someone accepts my offer on Vinted, and £14 has landed in my account from something I sold. So I treat myself to another jacket (a waterproof one for hiking) and pay the difference, £8.09.

12:20 p.m. — Use my break to drive to Tesco to get some last minute bits for this weekend for my mum: flowers, a candle, chocolate and prosecco as well as some batteries and some Quorn picnic eggs (iykyk), four of which get eaten on my drive back to the office, £18.59. I also fill up on fuel, £16.09.

12:40 p.m. — One of our clients has decided they want to make amendments for a job happening first thing Monday (typical that they’ve had all week to decide this) so I assist my colleague with the H&S side of things. Get completely sucked into this for a few hours as we rush to get it all together.

3 p.m. — End up eating the whole packet of picnic eggs instead of my healthy lunch I bought in with me. Oooops.

5:20 p.m. — Drive home, via the Co-op for some crisps and hummus, £3.25.

6 p.m. — Pyjamas on and onto the sofa with a blanket to watch the last episode of Lost, which me and B have been watching over the last few months — it’s finally time for the notoriously bad ending. We snack on our crisps and dip.

8:30 p.m. — Our friend G is around the corner and asks if we fancy meeting for a drink. I’m knackered but my productivity/social guilt takes over and I quickly change back into outside clothes again.

9 p.m. — B buys me an Aperol spritz and we stay for an hour or so before leaving the others and heading back.

10:10 p.m. — We’re both starving so we chuck some chicken burgers in the oven. Head to bed after we’ve eaten to watch a couple of episodes of Taskmaster, then go to sleep.

Total: £46.02

8:45 a.m. — Wake up to a lovely oat latte in bed. B has a long day of work today so I’ve said I will drop him off.

9:20 a.m. — Laze in bed until it’s time to head off. I last minute decide to get dressed into my workout clothes, to go for a run on my way home.

10 a.m. — Drop B off and drive to the harbour, where I park up and go for a run. Message my mum to check if she needs anything. She’s been ill this week so I’m going to visit her today. She sends me a list as well as transferring me some money for it.

10:35 a.m. — Asda is hectic but I manage to get Mum everything on her list, and drive back home to get ready.

1:50 p.m. — Arrive to my mum’s house, chat with her, my stepdad and little brothers for a few hours and give her presents and flowers. Help my mum prep a soup for later, chucking all the ingredients I got her this morning into the slow cooker. I have a slice of peanut butter on toast as I realise I’m starving and haven’t had any food today.

5 p.m. — After a few hours catching up it’s probably time I head home to get ready to go out tonight and pack for tomorrow. On the drive home I stop at the services and end up in M&S as I’m hungry again; £3.27 on a vegetable samosa and some reduced mini yum yums.

6:45 p.m. — B calls to say he’s still going to be another couple of hours so I pop into the Co-op again on my way home to pick up a pizza for us to have before we go out. Get a pepperoni pizza and bottle of soda water, £5.50.

8:20 p.m. — Get myself ready at snail speed now I know B isn’t going to be back for a while. I pack my case for tomorrow as I’m going back to my hometown, make myself a drink and put on some music to get me ready for this evening.

9 p.m. — Briefly consider joining my friends at their house for pre-drinks — we are all going out tonight but to different events — but quickly decide against it as it’s raining which would mean getting a Uber/bus there and back.

10 p.m. — Finally, B is home, we eat the pizza and have a couple of drinks.

11 p.m. — Last entry is 11:30 p.m so we order an Uber instead of the 18-minute walk in the rain. I pay for this, £9.95.

11:45 a.m. — B buys us a drink each and we join the crowd to watch the DJs.

Total: £18.72

3 a.m. — We stay until the last DJ, who is by far the best of the night, before calling it. We walk home as the rain isn’t so bad now. The venue wasn’t my favourite, but it’s been nice to spend some fun time with B.

3:30 a.m. — No better feeling than taking off my makeup — fall into bed and doze straight off.

8:30 a.m. — Up and feeling surprisingly energetic despite the lack of sleep. Pack the last of my bits, do my skincare and put my hair in heatless rollers for the train. Make a smoothie and a coffee to go for my 15-minute walk with B to the station.

9:50 a.m. — B sees me off and I make my pre-paid train by the skin of my teeth (my usual style). Manage to find a seat and settle in to do my makeup while listening to some music. Take my rollers out and the hair is looked successfully blown out, so it was worth looking a bit silly on my walk and on the train after all.

11:50 a.m. — Arrive to my hometown. My dad picks me up from the station to drop me off to the health club where I’m meeting my nan, aunties and cousins for an ABBA brunch.

12:30 p.m. — Buy a bottle of prosecco for me and my cousins E and A, £26.25 (that’s even with a discount using my auntie’s membership card, ouch). We all have a roast dinner (included) and enjoy the tribute band.

3 p.m. — After the event ends, me and my cousin E decide to walk back to my auntie’s house to get some extra steps in rather than Uber. Once back there, we have some Aperol spritzes using supplies I bought with me. Some more family and friends turn up, my uncle gets his guitar out and we all have a good sing along.

10 p.m. — I’m done in after a long afternoon of drinking. My little sister gives me a lift back to my cousin E’s house; we get chips from the kebab van on the way, £5.

10:30 p.m. — Wash makeup off and try to down as much water as I can before going to sleep.

Total: £31.25

7:50 a.m. — Regrets. I feel terrible.

8 a.m. — Grab my laptop and log in via bed, where I stay for much the day. Work through my emails, and draft a template for a new audit format, which I send to my manager for review.

12 p.m. — Order some disappointing katsu chicken noodles from Uber Eats with my cousin E; £11.65 for my share.

5 p.m. — Finish work and my cousin E kindly gives me a lift over to my brother R’s flat, to visit him, his wife P and my three little nephews.

6 p.m. — P does us a lovely roast for dinner, and I play some games with my energetic nephews while they show me a new fancy dress outfit every five minutes.

7:30 p.m. — Say my goodbyes and walk the 15 minutes to the station for my train back to Bristol. Feeling fulfilled after some quality time with all my family. I’m the only one who doesn’t live in our hometown, and I often worry I’m missing out, especially with the little ones.

8:25 p.m. — Grab a chocolate bar while I have 10 minutes to change trains, £2.15. Start watching The Lost Flowers of Alice Hart on my journey and I’m obsessed.

9:25 p.m. — Back to Bristol; B was going to meet me but didn’t want to miss the end of the football, so he pays for me to get an Uber instead.

10:25 p.m. — Showered and in bed with M, perfect.

Total: £13.80

Food & Drink: £116.29

Clothes & Beauty £27.31

Home & Health: £0

Entertainment: £0

Travel: £26.04

Other: £0

Total: £169.64

Conclusion

“I enjoyed tracking my spending this week, and I’m not surprised I spend the most on food and drink! Having a packed lunch and snacks through the day does help me curb impulsive Tesco lunch trips while in the office, and utilising some alcohol I already had at home saved some money this week, too. In the last year I’ve tried to be a lot more conscious with fashion: when I do buy clothes it’s usually on Vinted or I will treat myself to a more expensive piece of slow fashion every few months (this is the area that I used to be very impulsive with). Since writing this diary I have decided not to take on the second job, keeping a healthy work-life-balance is more important to me, and having time to enjoy my new city!”

Like what you see? How about some more R29 goodness, right here?

Money Diary: A Nursery Practitioner On £21,840

What's Your Reaction?

/cdn.vox-cdn.com/uploads/chorus_asset/file/24748328/236706_Mac_Pro_AKrales_0094.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/23437484/acastro_220503_STK084_0001.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25454244/Screenshot_2024_05_18_at_12.02.42_PM.png)