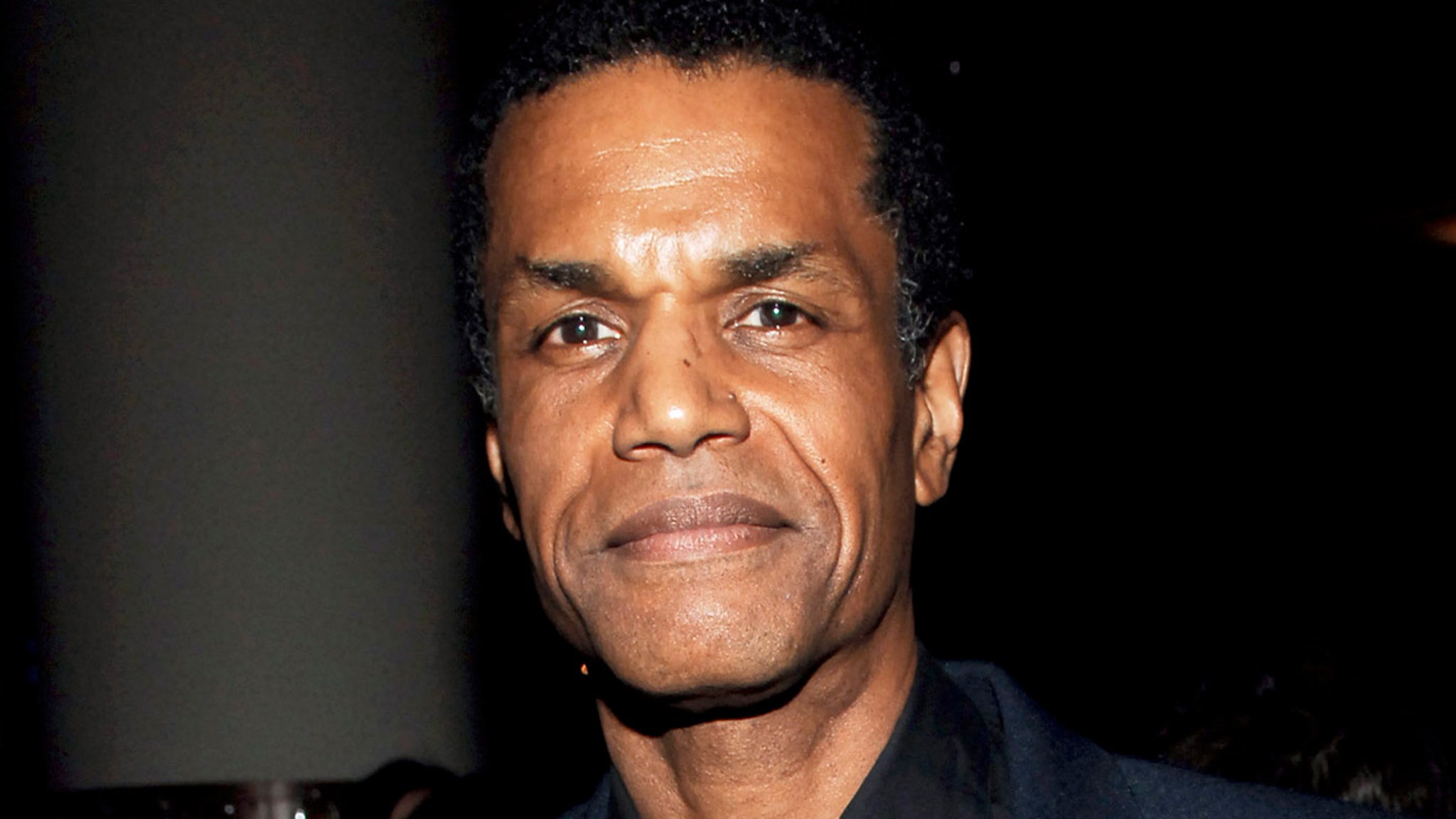

Shared equity provider EquiFi names Paul Giangrande to head mortgage division

Paul Giangrande, who has more than 30 years of mortgage and financial services experience, will look to grow the company’s footprint in more states.

San Jose-based EquiFi Corp., a provider of shared equity financing products, announced Thursday that it hired Paul Giangrande as a corporate executive vice president and president of its mortgage division.

Giangrande previously served as president of AmeriCash Mortgage and has more than 30 years of experience in the financial services and mortgage arenas. At AmeriCash, he oversaw more than 300 employees and helped the company close more than $18 billion in home loans.

“Paul brings a distinguished reputation in the mortgage industry with an uncanny sense of distribution. We are honored to have him lead our expanding mortgage financing efforts,” David Shapiro, EquiFi’s CEO and founder, said in a statement. “His impressive industry acumen and established mortgage credentials add significant strength and valuable perspective to our management team.”

In his new role, Giangrande will initially work toward scaling the company’s state licensing efforts to grow future market opportunities. According to its website, EquiFi is currently available in California only but is set to expand to more than a dozen other states.

Giangrande will also lead negotiation efforts for wholesale brokerage agreements with mortgage companies that seek to partner on EquiFi’s home equity investment (HEI) contract and other products. And he will oversee development and implementation of the firm’s marketing strategy and distribution processes.

“EquiFi is a company unlike any other in our business, offering homebuyers and homeowners the ability to utilize equity financing in a home to help achieve their financial objectives,” Giangrande said in a statement. “Every consumer deserves to work with a trusted advisor when financing their homes, and I am excited to join EquiFi to help change this industry for the better.”

Shared equity agreements, also known as home equity investments, are growing in prominence in the home lending space, although they remain small in comparison to traditional mortgage volumes.

Companies such as Aspire, Hometap, Point, Rook Capital, Splitero, Unison and Unlock offer alternatives to home equity loans, home equity lines of credit (HELOCs) and cash-out refinances by allowing homeowners to access equity without taking on installment-based debt repayments. Homeowners typically repay the funds provided by selling their property, with the HEI provider recouping their initial investment plus a portion of the sales price.

The products have gained traction due to interest from secondary market investors, who have purchased billions in securities over the past few years. According to data from DBRS Morningstar, at least nine securitizations involving HEI-type agreements totaling $1.89 billion have been issued since August 2021.

What's Your Reaction?

/cdn.vox-cdn.com/uploads/chorus_asset/file/25512791/Screenshot_2024_06_30_at_4.37.29_PM.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24522989/H_Herrera_keyboard_buying_guide.jpg)