Money Diary: A Senior Partnerships Manager On £65,000

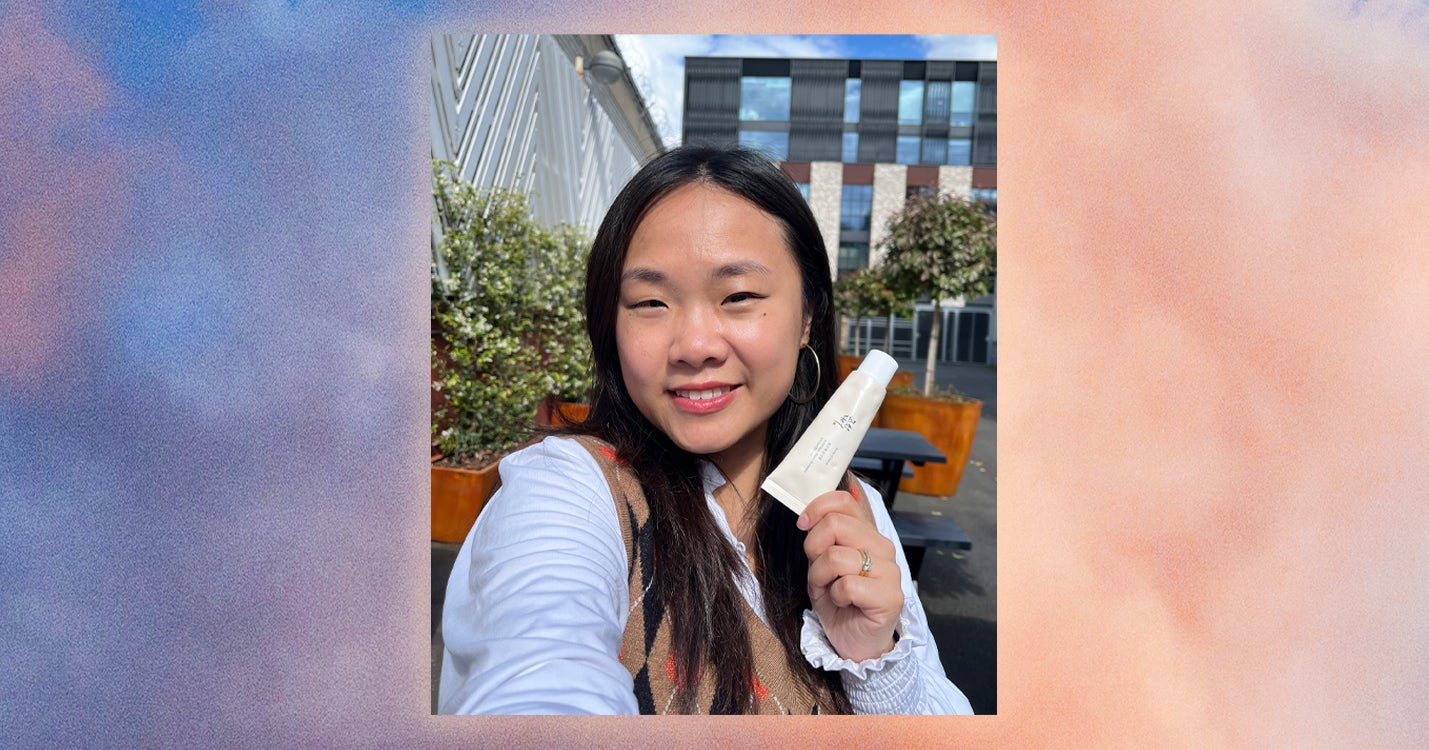

Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last penny.“I’m 33 and live in London with my husband and our cat. I previously wrote a Money Diary where I had just quit my job, and what followed was quite a rollercoaster. I was unfortunately made redundant after just less than a year in my job, rushed into a new job as I was spending so much on wedding planning, and have recently quit that one due to another toxic work environment (this one was way worse). I’ve learned a lot about what I want from a job in the future, and also been trying to save more so that I don’t ever get trapped in a job that destroys my mental health ever again. Since my last diary, I have gotten engaged and married and paid off my student loan. The wedding cost around £30,000 and we managed the cost of this with a £15,000 loan to manage cash flow and get some discounts on paying upfront (this was paid back in 15 of the 24 months of the agreement) and we received maybe £5,000 from our parents in total.”Occupation: Senior partnerships manager Industry: Currently fin tech, soon to be hospitality.Age: 33Location: LondonSalary: £65,000 (This is the same at my new job.)Paycheque amount: £3,742 — I assume this will reduce a little as my pension contributions may be higher.Number of housemates: One husband, one fur baby.Pronouns: She/herHousing costs: £949 mortgage. We pay all housing costs from the joint account.Loan payments: £45 on a sofa bed paid from the joint account (there are maybe six payments left).Savings? £4,263 in my personal savings, £3,100 in joint savings. We recently bought a car in cash for £11,100 so this depleted my savings but the finance options weren’t good enough to consider. My husband pays me back in chunks for the car as it came from my savings, but he isn’t paying this month due to it being an expensive one.Pension? £35,248.17 in Pension Bee and £5,000-£6,000 in my current pension, which will be transferred in a few months. Utilities: £130 service charge, £14 pet insurance, £47 car insurance, £241 council tax, £49 life and critical illness cover (this is covered in my new role so I may cancel it), £54 internet, £13 TV license, £110 gas and electric, £60 water. All other monthly payments: £45 phone payment, £195 gym. Subscriptions: £21.25 supplements, £24.99 Skin + Me, £4.77 Oura membership, £25 Nespresso.Did you participate in any form of higher education? If yes, how did you pay for it? I did a sandwich degree starting in 2007 so paid around £3,000 per year. I took out a full loan for three years and my dad paid the £700 course fee for the year out. He also paid my rent. I worked from second year onwards, earning a salary of £18,000 on my sandwich year, which I pretty much wasted. I had no understanding of money at the time and regret not teaching myself. I left with £22,000 of debt. Growing up, what kind of conversations did you have about money? None, hence my lack of knowledge when I started earning. We were always comfortable, I went on nice holidays and my mum didn’t have to work. When my parents split, money was a huge source of tension but was never in short supply. If you have, when did you move out of your parents’/guardians’ house? I was in and out until I was 25 due to periods away at uni, breakups and being out of work. At what age did you become financially responsible for yourself? Does anyone else cover any aspects of your financial life? I could not maintain my lifestyle without my husband, who earns around £90,000 per year (it varies). My parents have also been extremely generous over the years. My dad and stepmum have gifted us about £40,000 to set us up with a good life. This mostly went on our flat deposit then some towards our wedding loan, and a bit towards the recent car purchase. Given I have always had an okay salary, I am embarrassed that I needed this help to be where I am now and I’m trying to save towards my future. What was your first job and why did you get it? Working in Primark at 16. Getting a job was not an option (my mum insisted). I quit when I went to uni as I couldn’t transfer to a different store. I didn’t work in my first year but aside from that, and a three-month career break, I have been employed since. Do you worry about money now? Not day to day, but my grandmother has recently needed to enter care and the costs are terrifying. I have shifted my focus to ensure I have enough money for my future so I can be comfortable in later life. I have a long way to go though. Do you or have you ever received passive or inherited income? No inheritance, although I have received a lot of gifted money in the last 10 years. Day One7 a.m. — Wake up to my cat begging for breakfast, she’s too cute to ignore. Today should be payday due to the bank holiday, but as usual, I’ve not been paid yet. Will check in with my boss later today to

“I’m 33 and live in London with my husband and our cat. I previously wrote a Money Diary where I had just quit my job, and what followed was quite a rollercoaster. I was unfortunately made redundant after just less than a year in my job, rushed into a new job as I was spending so much on wedding planning, and have recently quit that one due to another toxic work environment (this one was way worse). I’ve learned a lot about what I want from a job in the future, and also been trying to save more so that I don’t ever get trapped in a job that destroys my mental health ever again. Since my last diary, I have gotten engaged and married and paid off my student loan. The wedding cost around £30,000 and we managed the cost of this with a £15,000 loan to manage cash flow and get some discounts on paying upfront (this was paid back in 15 of the 24 months of the agreement) and we received maybe £5,000 from our parents in total.”

Occupation: Senior partnerships manager

Industry: Currently fin tech, soon to be hospitality.

Age: 33

Location: London

Salary: £65,000 (This is the same at my new job.)

Paycheque amount: £3,742 — I assume this will reduce a little as my pension contributions may be higher.

Number of housemates: One husband, one fur baby.

Pronouns: She/her

Housing costs: £949 mortgage. We pay all housing costs from the joint account.

Loan payments: £45 on a sofa bed paid from the joint account (there are maybe six payments left).

Savings? £4,263 in my personal savings, £3,100 in joint savings. We recently bought a car in cash for £11,100 so this depleted my savings but the finance options weren’t good enough to consider. My husband pays me back in chunks for the car as it came from my savings, but he isn’t paying this month due to it being an expensive one.

Pension? £35,248.17 in Pension Bee and £5,000-£6,000 in my current pension, which will be transferred in a few months.

Utilities: £130 service charge, £14 pet insurance, £47 car insurance, £241 council tax, £49 life and critical illness cover (this is covered in my new role so I may cancel it), £54 internet, £13 TV license, £110 gas and electric, £60 water.

All other monthly payments: £45 phone payment, £195 gym. Subscriptions: £21.25 supplements, £24.99 Skin + Me, £4.77 Oura membership, £25 Nespresso.

Did you participate in any form of higher education? If yes, how did you pay for it? I did a sandwich degree starting in 2007 so paid around £3,000 per year. I took out a full loan for three years and my dad paid the £700 course fee for the year out. He also paid my rent. I worked from second year onwards, earning a salary of £18,000 on my sandwich year, which I pretty much wasted. I had no understanding of money at the time and regret not teaching myself. I left with £22,000 of debt.

Growing up, what kind of conversations did you have about money?

None, hence my lack of knowledge when I started earning. We were always comfortable, I went on nice holidays and my mum didn’t have to work. When my parents split, money was a huge source of tension but was never in short supply.

If you have, when did you move out of your parents’/guardians’ house?

I was in and out until I was 25 due to periods away at uni, breakups and being out of work.

At what age did you become financially responsible for yourself? Does anyone else cover any aspects of your financial life?

I could not maintain my lifestyle without my husband, who earns around £90,000 per year (it varies). My parents have also been extremely generous over the years. My dad and stepmum have gifted us about £40,000 to set us up with a good life. This mostly went on our flat deposit then some towards our wedding loan, and a bit towards the recent car purchase. Given I have always had an okay salary, I am embarrassed that I needed this help to be where I am now and I’m trying to save towards my future.

What was your first job and why did you get it?

Working in Primark at 16. Getting a job was not an option (my mum insisted). I quit when I went to uni as I couldn’t transfer to a different store. I didn’t work in my first year but aside from that, and a three-month career break, I have been employed since.

Do you worry about money now?

Not day to day, but my grandmother has recently needed to enter care and the costs are terrifying. I have shifted my focus to ensure I have enough money for my future so I can be comfortable in later life. I have a long way to go though.

Do you or have you ever received passive or inherited income?

No inheritance, although I have received a lot of gifted money in the last 10 years.

7 a.m. — Wake up to my cat begging for breakfast, she’s too cute to ignore. Today should be payday due to the bank holiday, but as usual, I’ve not been paid yet. Will check in with my boss later today to remind him.

9 a.m. — Sit down at my kitchen table/desk to start my work day. My day is pretty quiet as I’m mostly working on my handover with my colleague and we do ad hoc sessions here and there. I’ve been struggling in this role as my boss is volatile and doesn’t let anyone have ownership of their work. After six months of trying, I’ve mostly been job hunting and trying to calm down angry clients who aren’t getting what they were sold.

12 p.m. — Stop for lunch and go for a walk. I stop in at the little Sainsbury’s for some carrots and onions to make lentil soup, £1.43. I did the Zoe test recently and my gut health is abysmal. I am trying to eat more veg, but my recent stress and anxiety has made me a very lazy cook.

3 p.m. — Join the weekly town hall which was moved due to the bank holiday. Try to show no reaction in my face while my boss (COO) goes on some bigoted rant for 20 minutes.

4:45 p.m. — Go to the gym. I try to go four times a week to justify my full membership instead of the three sessions per week, which is £30 cheaper.

6 p.m. — Get home, still haven’t been paid. Message my boss on Slack reminding him, but he’s offline.

9 p.m. — Still haven’t been paid. I can see all my bills pending so I start to freak out. Luckily my husband was paid on time, but I don’t want to ask him to spot me. I decide to borrow from my savings, withdrawing £3,200, transferring £1,500 to our joint account, moving £500 of that to our holiday pot), £1,000 into my “pocket money” pot (I give myself £250 a week), £70 aside for one therapy session, £300 into my bills pot to cover the gym, my phone and anything else that might pop up. I then pay off my Monzo Flex: £49.99 off my Zoe test, £37 I spent on tickets to exhibition, £75.65 on some holiday clothes I bought from ASOS and then paying off the £76.60 of expenses I accumulated at a client meeting last week (I will be paid back for these).

11 p.m. — Go to bed stressed AF, hoping, but doubting, that my pay will hit my bank overnight.

Total: £240.67

7 a.m. — Wake up again to a hungry kitten (she’s four but forever a kitten in my heart), and shock horror, no pay. I message the CEO on Slack as he’s online, saying I’m struggling to reach the COO and ask if he knows what’s up.

11 a.m. — In the gym, a nice bit of physical exertion to distract from my increasing anxiety.

12 p.m. — Get home, make some eggs for lunch. Husband is feeling groggy so I drag him out for a walk to get some bits in Boots for our upcoming holiday, £10.65. We then go to a cafe for a coffee and share a doughnut (I let him pay).

1 p.m. — Grab some dinner bits in Waitrose and head home, £14.13.

3 p.m. — We’ve been tidying the flat and setting up for my friend who’s staying this weekend. I set up the sofa bed and make the spare room a bit less “officey”. Then sit down and purchase some new shapewear from Amazon, £30.35.

4 p.m. — Friend arrives after a long drive with a migraine so we just chill and watch a terrible film.

7 p.m. — Eat the chicken Kiev I got in Waitrose with some microwave mash and veg, while half-watching horror trash on TV.

10 p.m. — We’re both knackered so get an early night ahead of a busy day tomorrow. Husband gladly reclaims the living room.

Total: £55.13

8 a.m. — Wake up slightly later today as husband has already fed the fur baby. I had grand ambitions to go for a run before my friend woke up, but an hour of staring at TikTok felt more suitable. I notice I have still not yet been paid, so I email both bosses at work reminding them of their contractual obligation to pay salary on time. I am FUMING (and very, very anxious).

9 a.m. — Friend awakens. I make coffee and a toasted bagel for me — she doesn’t want food so early but I am forever hungry. We get ready for the day.

10:30 a.m. — We walk down to the station and get the train into London. My friend stops at Sainsbury’s for a pastry (I don’t get anything but willingly accept a bite of a cinnamon roll).

11 a.m. — We walk through South Bank and over into Covent Garden for a mooch, stopping at various tourist traps along the way. Find ourselves in the Twinings shop where we sample lots of teas but don’t buy anything as neither of us really likes tea, just freebies. I really need the loo but I am shocked to see it’s £1.50 so I hold it in. During our shopping I grab THAT bag from Uniqlo in a cute straw material for £25.10 and spend £59.18 in Boots on the Dr Jart Cicapair, Instant Eraser Concealer, a white Barry M nail polish and the Urban Decay Moondust palette (this is quite frankly, a necessity.)

1:30 p.m. — We find ourselves in Seven Dials market and grab an empty spot. I get some Japanese curry with rice for £11.50 and my friend gets a very impressive-looking sandwich and crinkle cut fries. I pinch some fries but I’m trying to be good(ish) before holiday.

3:20 p.m. — We stop for a coffee break, my friend pays and I transfer her for my iced Americano with a splash of oat milk, £4.

4 p.m. — We arrive at Somerset House for the exhibition and I’m pretty shocked at how rammed it is. Yes, it’s a Saturday but it’s a ticketed entry.

4:50 p.m. — We peruse the gift shop but it’s all very expensive and ultimately unnecessary, so we leave empty handed.

5:30 p.m. — We go to a bar my friend found online but sadly, it’s disappointing. We both get an espresso martini for £16.10 and while it’s tasty, the vibes are off so we leave.

6 p.m. — We head over to the theatre where we’re seeing Cruel Intentions The Musical this evening and see there’s a pub next door. The vibes are infinitely better here. We order snacks and a drink for £21.45 and both apply some of my new glitter eyeshadow. It’s stunning.

7 p.m. — The show starts at 7:30 p.m. so we move over to the theatre, and grab a drink to take in. There's an offer on Kir Royale so we get two, I transfer £12.

9:30 p.m. — The show finishes, it was WONDERFUL. Full of noughties bangers, so highly recommend! We walk to the station and take a tube and a train home. Although we did the journey this morning, my friend is shocked at how quickly we get back.

Total: £149.33

12.30 a.m. — Monzo notification wakes me up, I’ve been paid! This is accompanied by quite a vague message about an admin error. I’m pretty furious as I know payroll is done manually and my boss simply forgot and is refusing to acknowledge it. I go back to sleep.

8 a.m. — Wake up, organise my money, putting £3,000 back into savings and move £500 extra into my bills pot to cover holiday expenses. I then keep the remainder on my card for this week’s spending. I get an email from my boss saying my “communication” was unacceptable when asking where my pay was and insisting on a formal meeting to discuss my approach. He’s very clearly trying to deflect from the issue. I’ve struggled with this man since I joined the company. He has said and done some shocking things but there’s nobody to hold him accountable. I start to spiral thinking how to respond.

9 a.m. — £15.80 comes out for travel yesterday.

10 a.m. — We get in the car to drive 40 minutes to an aerial yoga class. My friend is a regular and we do it when I visit her, but this is the closest one I could find for us.

12 p.m. — We finish the class. It was much harder than the few I’d done previously but really fun. I had promised my friend a trip to Gail’s but it’s further away than I thought (and possibly not even open), so we head home.

1.30 p.m. — We do find a Gail’s which I just forgot was there. I get a challah sandwich for £9 and my friend gets an assortment of goodies.

2.30 p.m. — We pop into Oseyo which I love. I spend £10.60 on various ramen and their incredible mango crêpes cakes. Then we go into one of those rogue-looking American sweet shops and I spend £6.98 on the most sour sweets I can find as I’ve heard they’re helpful when you’re having a particularly bad anxiety episode.

3 p.m. — We head home for a laze, sit on the sofa bed and watch American Horror Stories, like Black Mirror but worse. We then end up watching season 1 of American Horror Story, it is significantly better than any other series and I will not accept further comments on this. I text a group WhatsApp and my brother-in-law for advice on the work issue so I don’t bombard my guest with my anxious thoughts. The cat joins us for a bit and we coo over her and take some pictures because she’s just adorable.

6:40 p.m. — We decide to order some Turkish food from Deliveroo, this comes to £24.57 for my half. We enjoy this in the kitchen, and chat to my husband who is trying to hide his annoyance that our dinner arrived in the middle of a match he was watching.

9:30 p.m. — My friend announces she’s tired so I head to my own room to spiral further. I read a bit of Hunting Adeline (if you know, you know) and eventually fall asleep.

Total: £66.95

9 a.m. — Everyone’s awake. I make coffee for everyone and have a toasted bagel. My friend wants to hit the road so I help her load up the car and she sets off. I tidy up for a bit until I head to my 11 a.m. bank holiday gym class where I tell some gym friends about my pay issues. Have a good rant about toxic masculinity in the workplace.

12 p.m. — Come home and cook some of my new noodles, plus I chuck in some leftover chicken from last night’s takeaway and some veg left over from Friday. Spend the rest of the day stressing about the work situation. My boss knows I’m leaving, and as the third person (of a team of six) to leave since November, it reflects pretty badly on him, so I rationalise that he’s lashing out. It doesn’t help though.

5 p.m. — After a very lazy day, husband suggests a takeaway. I opt for something “light” (as light as a takeaway can really be) and get a Vietnamese salad with chicken, £37.98 from the joint. I should have got tofu as the chicken tastes weird. Decide the only solution is to crack out chocolate.

6 p.m. — A Kickstarter I’ve been following launches so I pledge £10 immediately, but I’m not charged unless they get the full pledge. It’s to fund a documentary about an old TV station called P-Rock which I was obsessed with as a young teen. I also share this in a relevant Facebook group and get some positive and very nostalgic responses.

9 p.m. — After a super-productive day of TV watching, spiralling and scoffing, I head to bed to read more of my book. Now we have the spare room back, I sleep in there as my husband and I are having a sleep divorce and I secretly prefer the sofa bed. I’ve been struggling with the first half of this book after devouring the first in the two-part series, but I’m finally getting into it.

Total: £37.98

7 a.m. — Awoken by the starving beast. I see that all the usual bills have come out of the joint account, see what’s left and shift a bit more into the holiday pot. My husband never seems to check the joint account and is always pleasantly surprised when I tell him we have savings for various expenses (such as the service charge which comes twice a year).

9 a.m. — Start the working day, sick with anxiety. Since I’m leaving, I’m determined to put my foot down, so I say I will only accept a meeting with an agenda and I need to understand the issue and if this is a formal disciplinary.

11 a.m. — I check out the seats on our upcoming flights and decide it’s worth the £104 to ensure we’re not sat next to the loos for ten hours. Husband agrees, £54 each.

12 p.m. — I decide to give ear candling a try as I’ve had some (what I assume is stress-related) tinnitus for a few weeks. I walk up to the appointment which takes 20 minutes or so and feels like a whole lot of nothing, but the lady doing it is lovely, £22.

1 p.m. — Back home and still no response, guess this meeting isn’t happening, crack on with my handover.

3 p.m. — The mother of all replies comes through, super offensive, patronising and gaslighting. The CEO is copied in, I metaphorically shit my pants.

4:30 p.m. — CEO rings me to say “What the fuck” and “I’m very sorry about what’s going on.” This feels like a huge relief to be reassured that I did nothing wrong and the reaction I got was unreasonable. I have to switch the call from my laptop to my phone as I’m heading out the door to my gym class, leaving me having quite a personal call in the street and then standing outside the gym for all to hear. I go into quite a lot of detail about how this behaviour has been eating away at me and ultimately led to me resigning. I have to end the call prematurely as class is starting but we agree to regroup later. He asks me to write up the issues.

6 p.m. — Leave the class having depleted some rage and anxiety and receive an £8 request for “dinner” from husband. He makes some delicious sticky chicken and rice, he’s a much better cook than I am.

7:40 p.m. — Still no further word from the CEO but I have written up the issues. I laugh as £77.60 comes through for my expenses, knowing the COO is probably getting an earful. I start to relax and watch a documentary on Netflix but I’m hardly paying attention. Transfer the money for my therapy session tomorrow. MUCH NEEDED.

9 p.m. — Another early night for more Hunting Adeline and sleep divorce. I read for about an hour before putting on the Sleep With Me podcast and immediately nodding off, this show is magic.

Total: £84

9 a.m. — Work work work work work, I hate my job so much. It’s the start of the month so I’m invoicing all our clients while showing someone else how it’s done. Should either of us be responsible for this? No. Is it a bloody mess because my boss didn’t let me fix the processes? Yes. Be calm.

11:20 a.m. — Receive another shocking message from my boss basically saying I’m so rude I shouldn’t be allowed to speak to clients and he wants everything I do recorded or him cc’d (we’ve received informal complaints from clients about this guy previously). Did I mention I’m LEAVING? I respond only to say I’m not responding and will be raising a formal grievance.

11:30 a.m. — I’m getting hungry but want to do a lunchtime workout so I just have two crumpets with cheese. Healthy. Then pay £7 to join an online dance class — you can’t be stressed or anxious when dancing to Kylie.

2:30 p.m. — I join a call with the CEO who is incredibly apologetic and says the COO is no longer allowed to contact me and to inform him if he does. He also shares some shocking information that COO is having some major responsibilities revoked due to evident issues in the team and general lack of progress. This feels so validating and such a huge win. We agree not to reduce my notice period (which I was pushing for) as they could only reduce it by a couple of days, and quite frankly, I’d rather have the money now there’s no chance of aggro and I can’t move the start date forward for my new job. We agree that I’m happy with the resolution and there will be no formal grievance… Yet.

4 p.m. — Head to therapy, still in a state of shock over the whole episode. We discuss my reluctance to raise issues when they begin, allowing them to become unbearable and send myself into a great big stressy ball of misery. We talk about how to advocate for myself more in the future but agree this is unlikely to happen again. I’ve learned in the past three years that startup life is very much not for me. I need a lot more structure and generally just more people around with specialised roles.

5:10 p.m. — Get into Superdrug 20 minutes before it closes for new foundation (L’Oréal hyaluronic acid serum. It’s a game changer), a mosquito bite zapper and a travel bottle of hairspray, £22.47.

5:30 p.m. — Head into Waitrose, grab some stir-fry veg and marinated tempeh, £5.50. I then go to Londis to collect a parcel of holiday clothes for husband, and grab an IrnBru for him and some hot chocolate mix for me, £6.23.

6 p.m. — Book four tickets to Chessington for Friday as husband and I have the day off to take our nephews, it costs £116 but comes out of the joint account surplus. Prices are insane and it’s probably going to be heaving, but the memories will be worth it. I make myself some stir-fry with my goodies from Waitrose.

7 p.m. — Husband gets home and I decide I deserve a bath. I found myself having way too many recently and our water bill shot up so I’m trying to ration it to one per week. I watch One Tree Hill and do a gloss mask on my hair. Shower myself down after stewing for 90 minutes and then fake tan.

9 p.m. — Join husband to watch some TV but I can’t focus due to the anxiety. We discuss our weekend plans of Chessington, a family birthday meal and then prepping our flat for the house sitters, then we have a cuddle to calm me down.

10 p.m. — Late one for me! I head off to the spare room for more reading. This is the last night of the sleep divorce, we’re going back to normal tomorrow. We’ve just both been sleeping really badly together so I needed to catch up on sleep to get through the work week before our holiday.

Total: £157.20

Food & Drink: £189.47

Clothes & Beauty: £223.40

Home & Health: £78.99

Entertainment: £153

Travel: £69.80

Other: £76.70

Total: £791.26

Conclusion

“I was in a really bad place when I wrote this diary and I barely even recognise myself. Since then, I have started my great new job and my mental health is slowly recovering (with the support of my new workplace’s Bupa cover). Writing this definitely held me accountable, not so much to my weekly expenditure, but more to my savings and pension, which I really want to build up. I’m currently on a spending ban for clothes and non-essential toiletries after going a bit nuts with the holiday and a few premium purchases, but I could still cut back in other areas to help me reach my financial goals. I have increased my pension contributions in the new job, taking me from 7% (total) to 10%. I’ve managed to save a little more despite an expensive few months. Hopefully, in another two years I’ll be much more secure.”

Like what you see? How about some more R29 goodness, right here?

Money Diary: A Freelance Copywriter On £36,000

What's Your Reaction?

/cdn.vox-cdn.com/uploads/chorus_asset/file/25517480/2023_Amazon_Fire_HD_10_Lifestyle_Press_Image_2.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24110035/226347_Kindle_SVasani_0004.jpg)

![Netflix Horizon Zero Dawn TV Show Reportedly In Trouble [Update]](https://i.kinja-img.com/image/upload/c_fill,h_675,pg_1,q_80,w_1200/cc9a42c0341c691ff31e3f12daeddc34.jpg)